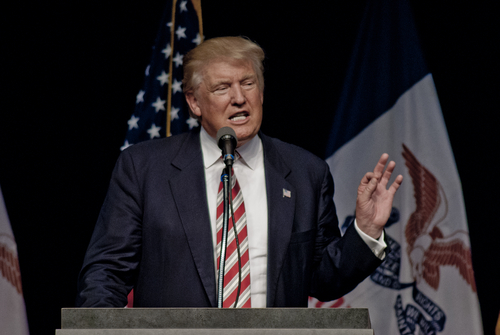

Former President Donald Trump has a major tax change in mind if he gets reelected to the Oval Office in November. During a campaign speech in Las Vegas on Sunday, he said that he would like to change the tax code to exempt tip income from federal taxes.

According to the Republican presidential candidate, he would like to eliminate the deduction of taxes on tips earned by restaurant and hospitality workers.

“So this is the first time I’ve said this, and for those hotel workers and people that get tips, you’re going to be very happy because when I get to office, we are going to not charge taxes on tips, on people making tips. We’re not going to do it, and we’re going to do that right away, first thing in office because it’s been a point of contention for years and years and years — and you do a great job of service, you take care of people,” he told the crowd.

“And I think it’s going to be something that is deserved — more importantly — popular or unpopular, I do some unpopular things too, if it’s right for the country, I do what’s right. But — so those people that have jobs in restaurants or whatever the job may be, a tipping job, we’re not going after it for taxes any more, that will be ended,” he added.

🚨 President Trump announces he will ask Congress to eliminate all taxes on TIPS for restaurant workers and hospitality workers pic.twitter.com/5EKGzXUbOk

— Trump War Room (@TrumpWarRoom) June 9, 2024

Under current law, tips are categorized as regular taxable income and service workers are required to report their tips to the IRS.

While any potential changes to taxation on tipped income would have to be approved by Congress, Trump’s proposal was met with enthusiasm from social media users. According to Journalist Laura Loomer, the GOP presumptive nominee’s proposal will be “a big hit with the service industry.”

“This will be a very popular position in Nevada, where tourism and entertainment make up a large segment of the workforce,” she added.

Wow. This is going to be a big hit with the service industry.

This will be a very popular position in Nevada, where tourism and entertainment make up a large segment of the workforce. https://t.co/qV1jw0ZIwd

— Laura Loomer (@LauraLoomer) June 9, 2024

“This is great for restaurant workers! Waiter and waitresses unite behind this guy,” another user added.

‼️ This is great for restaurant workers! Waiter and waitresses unite behind this guy… ⬇️ https://t.co/8PN1tuLnpE

— RossBlankenship.eth 🌄 (@RossBlankenship) June 9, 2024

“Every step closer to eliminating the Income Tax is a win for the People!’ a third user added.

This is HUGE!

Every step closer to eliminating the Income Tax is a win for the People! https://t.co/qemhIJA0ST

— Merissa Hamilton 🗳 ⛽ 🗽🔥 (@merissahamilton) June 9, 2024